January 6, 2025

Pakistan's telecommunications industry has demonstrated resilience in recent years, achieving a YoY growth of 17% in the fiscal year 2023 and generating approximately 3 billion USD in revenue. As one of the key sectors in realizing the Digital Pakistan vision, it supports the development of various fields such as business, education, agri-tech, trade, SMEs, and financial inclusion. With the consolidation and development of the industry, the expansion of business portfolios, and the introduction of 5G commercial services, the telecom industry is poised to embrace new growth opportunities.

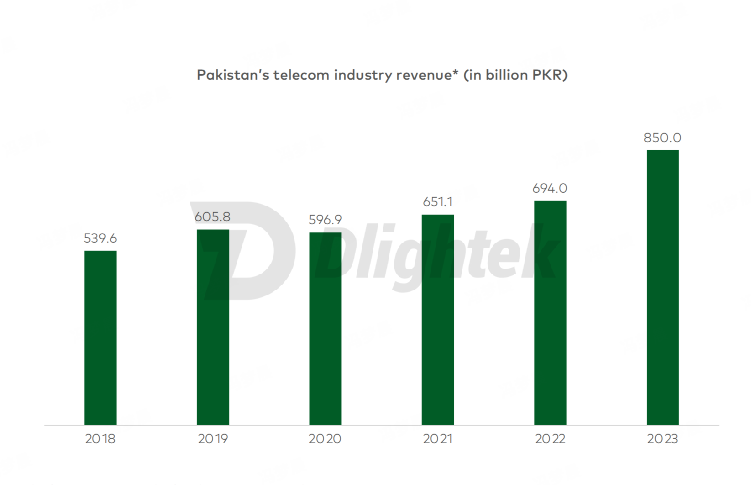

Pakistan's telecom industry generated 850 billion PKR in revenue

According to Pakistan Telecommunication Authority (PTA), the market size of Pakistan's telecom industry has been continuously growing. In FY2023, Pakistan's telecom industry generated 850 billion PKR in revenue, showing a 17% growth compared to the previous year. Among the total revenue of 850 billion PKR, mobile revenue accounted for 67%, reaching approximately 572 billion PKR.Over the past five years, the sector has attracted a total of 5.7 billion USD in local investment and 1.4 billion USD in foreign direct investment.

Pakistan’s telecom industry revenue,

Source: Telecommunications Industry in Pakistan 2024, Dlightek

Pakistan's urbanization rate is 34.7%, indicating large room for improvement. Karachi and Lahore are among the most populous cities in the country. As the urbanization process advances, the telecom industry is expected to encounter more growth opportunities.

Telecom subscribers in Pakistan reached 192 million

PTA Annual Report shows that at the beginning of 2024, telecom subscribers in Pakistan reached 192 million, equivalent to about 80% of the total population.

With the improvement of telecom technology, the number of 3G subscribers dropped in Pakistan, while the number of 4G subscribers grew rapidly over the past five years. In FY2023, over 100 million users were on 4G networks, and this growth momentum is expected to continue.

.png)

Number of 3G and 4G subscribers in Pakistan,

Source: Telecommunications Industry in Pakistan 2024, Dlightek

According to Cable.co.uk, the cost of mobile data in Pakistan has decreased by 71% since FY2018. The current cost of 1GB is only 0.12 USD. In the 2023 global league table of mobile data costs in 237 countries/regions, Pakistan is the sixth lowest in terms of cost. However, the average revenue per user (ARPU) in Pakistan is low, posing challenges to the profitability of telecom companies.

Four operators dominate the market in Pakistan

Currently, Pakistan has four major operators: Jazz, owned by Dutch telecom company VEON, China Mobile Pakistan’s Zong, Ufone, a wholly-owned subsidiary of PTCL, and the Norwegian operator Telenor.

The market size of Pakistan's telecom industry has been continuously growing. Among the total revenue of 850 billion PKR, mobile revenue accounted for 67%, reaching approximately 572 billion PKR. In June 2024, Jazz led other operators with a market share of 37.06%. Jazz also held a leading position in terms of the number of 4G subscribers. In terms of network performance, Zong excelled in multiple network performance indicators.

.png)

Market share by mobile operator in Pakistan (Jun 2024),

Source: Telecommunications Industry in Pakistan 2024, Dlightek

Jazz is Pakistan's leading mobile operator. With over 71 million subscribers, the company occupies the top position in both user base and revenue market share. In terms of core business, Jazz continues to expand the coverage and capacity of its 4G network, adding nearly 1,000 4G sites in 2023 to improve service quality. Jazz has the largest 4G user base in Pakistan, with over 40 million 4G subscribers.

Zong is the brand operating under the subsidiary of China Mobile and has become the second largest mobile operator in Pakistan, boasting 49 million subscribers. Zong is favored by users for its high-quality network service. According to an Opensignal report, Zong outperformed in terms of video experience, games experience, and download speed experience. In addition, its network availability and consistency were also recognized.Zong was the first operator in Pakistan to conduct 5G trials.

Leading operators are at the forefront of innovation, actively launching a series of mobile apps and services covering verticals such as fintech, entertainment, gaming, and social, etc.

Telenor and Jazz have respectively launched fintech services Easypaisa and JazzCash, which have become the two largest mobile payment applications in Pakistan, with active users in December 2023 increasing by 27% and 54% respectively compared to January of the same year. The introduction of fintech services has promoted the digitalization of payment-related businesses, effectively transforming Pakistan's financial landscape.

Jazz's entertainment platform Tamasha was launched in 2021 and has become Pakistan's largest local OTT platform, offering live streaming channels and video-on-demand content, such as cricket tournaments.

One of the fastest-growing mobile application markets

Pakistan has been one of the fastest-growing mobile application markets in recent years, with app downloads increasing by nearly 35% YoY in 2022. Higher broadband penetration and 4G adoption have facilitated this growth trend.

Pakistan internet users are relatively more likely to use WIFI. More than 40% of users spend more than 50% of their connectivity time on WIFI.

Despite the growth in mobile app downloads, the potential of local app developers has not been fully tapped. In 2023, slightly over 4,800 apps were released by local developers, a YoY decline of 11.4%. In terms of active users, global leading social and entertainment apps such as Facebook, YouTube, and WhatsApp Messenger remain the most popular among users.

.png)

Time on network generations in selected South Asian countries (Q3 2023),

Source: Telecommunications Industry in Pakistan 2024, Dlightek

Plan to launch commercial 5G services, strengthen international connectivity and data center construction

Pakistan is actively promoting the construction of digital infrastructure and strengthening international connectivity. In 2021, the government began formulating 5G policy guidelines. To accelerate the deployment, relevant departments and industry participants need to provide broader fiber network, reduce costs, address tax challenges, and offer a favorable investment and business environment. And the Pakistani government expects to launch 5G services in 2024.

According to Data Center Dynamics, Pakistan has seven submarine cable connections. Service providers such as Pakistan Telecommunication Company Limited (PTCL) are continuously investing in cable networks to meet both current and future demands.

.png)

Data center revenue in selected South Asian countries (2023),

Source: Telecommunications Industry in Pakistan 2024, Dlightek

The Pak-China Optic Fiber Cable (OFC) is the first cross-border terrestrial cable directly connecting China and Pakistan. It is also an important ICT based project under the framework of the China-Pakistan Economic Corridor (CPEC).

According to Statista, Pakistan has over 20 data centers, mainly located in Lahore, Karachi, and Islamabad, operated by companies such as PTCL and Multinet, etc. The data center market in Pakistan is the second largest in South Asia, with market revenue of approximately 940 million USD in 2023.

As a pillar of the digital economy, the progress of the telecommunications industry is crucial for the nation's digital competitiveness. Leading operators in Pakistan have experienced different development phases, launched a series of digital services in various vertical domains to meet the diverse needs of users, and redefined the digital landscape. In the face of upcoming 5G opportunities, all stakeholders need to work together to drive investment, enhance technological capabilities, and reduce uncertainties. This joint effort will help unleash the potential of the telecom industry and realize the vision of promoting socio-economic growth through digital transformation.

Downland the report here.

#Pakistan #Telecom #MobileOperator #5G

.jpg)

.jpg)

(1).jpg)

.jpg)

.jpg)

.jpg)

.png)

.png)

.png)

.png)

.webp)

图片2@2x.png)

All rights reserved.