March 5, 2025

As a rapidly developing Southeast Asian economy, the Philippines is experiencing unprecedented growth in its fintech industry. Increasing internet penetration, widespread smartphone adoption, and strong government support for the digital economy have fostered a flourishing fintech ecosystem. This growth is bringing more convenient financial services to the archipelagic nation of over 7,000 islands.

Philippines leads Southeast Asia in economic growth, with a growing digital economy

Philippine Statistics Authority data shows the digital economy reached 2.05 trillion PHP (35.4 billion USD) in 2023, contributing 8.4% to GDP, a 7.7% growth from 2022's 1.90 trillion PHP (32.8 billion USD). According to the 2022 Financial Inclusion Survey by the Bangko Sentral ng Pilipinas (BSP), financial account ownership increased from 56% in 2021 to 65.6% in 2022. However, the financial inclusion rate in the Philippines still lags behind other Southeast Asian countries such as Singapore and Indonesia.

.png)

Active e-money accounts in the Philippines (2020-2022) (in million),

Source: 2024 Philippines Fintech Industry Report, Dlightek

The Philippine economy demonstrated resilience in 2023, achieving a growth rate of 5.6%, making it the fastest growing economy in Southeast Asia. The World Bank forecasts that its economy will maintain growth momentum, with an average growth rate rising to 5.9% between 2024 and 2026.

.png)

Philippines GDP (2018-2023) (in billion USD),

Source: 2024 Philippines Fintech Industry Report, Dlightek

The Philippines is the second most populous country in Southeast Asia and the 13th most populous country in the world. The country has a large and educated young population, with a median age of 25 in 2023.

Fintech funding reached new heights after digital payments transformation

Since the release of the Digital Payments Transformation Roadmap in 2020, the fintech industry in the Philippines has seen a record amount of funding in 2021. According to data compiled by United Overseas Bank (UOB), fintech companies in the Philippines raised a total of 342 million USD in the first half of 2021, more than double the amount raised in the entire year of 2020 and surpassing the previous record of 248 million USD set in 2018.

Furthermore, according to a report released by Google, Temasek and Bain & Company, digital financial services revenue in the Philippines is projected to reach 2.8 billion USD by 2025, with a compound annual growth rate of 20% from 2019 to 2025.

.png)

Philippine fintech funding subcategories and companies (2021) (in million USD) ,

Source: 2024 Philippines Fintech Industry Report, Dlightek

BSP consistently promotes online payments for a cashless society. Key initiatives include the 2009 Circular No. 649 regulating electronic money issuers, the 2015 National Retail Payment System (NRPS) to promote digital payments. Under BSP's guidance, “QR Ph” was introduced in 2019 as the national QR code standard, with BSP mandating all payment service providers to offer QR code payments. In 2020, BSP issued digital banking licenses, with six digital banks licensed by 2023. These initiatives, along with QR code payments, continue to advance the Philippines' fintech landscape, filling financial service gaps and driving innovation.

Payments and lending remain the mainstream of the fintech market

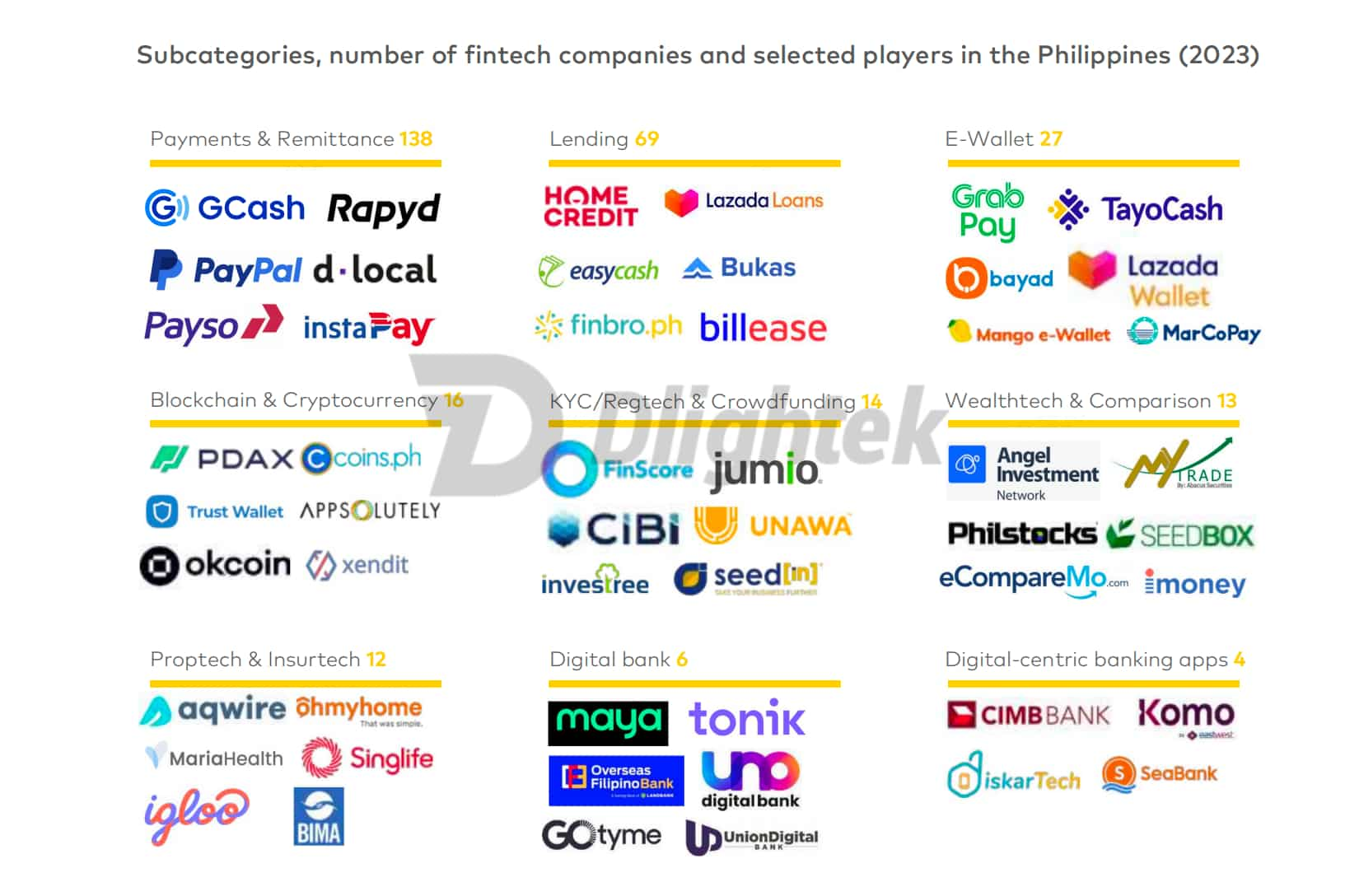

The Philippines' fintech industry is booming. As of 2023, 299 companies are active in the fintech market in the Philippines, covering multiple sectors including payments, lending, wealthtech, insurtech, and blockchain.

According to data from the Fintech Alliance Philippines, payments and lending remain the mainstream of the fintech market, accounting for 45% and 30% of market share respectively. Payment services include mobile payments, and cross-border transactions, etc., while lending services encompass P2P lending, online loan platforms, and digital credit, etc. These figures not only demonstrate the significant position of payments and lending in the fintech ecosystem, but also reflect strong consumer demand for convenient and efficient financial services.

Subcategories, number of fintech companies and selected players in the Philippines (2023) ,

Source: 2024 Philippines Fintech Industry Report, Dlightek

Mobile banking apps represent half the market

According to DataSparkle, the market concentration1 of the Philippines' finance app market is around 60%, indicating a relatively concentrated market that still has some room for competition. From January to December 2023, the number of active users of finance apps in the Philippines grew by 44%. Among the top 10 finance apps by active users in 2023, mobile banking apps accounted for 50% of the market share, while digital wallets and payment apps held 30%. Furthermore, the majority of developers for the top 10 finance apps in the Philippines are local companies.

.jpg)

Top 10 finance apps by active users in the Philippines (2023),

Source: 2024 Philippines Fintech Industry Report, Dlightek

GCash, launched in 2004 as an SMS-based money transfer service, introduced its mobile app in 2012, marking its digital transformation. Operated by Mynt, a joint venture of Globe Telecom, Ayala Corporation, and Ant Financial, GCash reached 76 million users and partnered with over 139,000 merchants by 2022.

As the Philippines' only ”double unicorn“ valued over 2 billion USD, GCash has expanded beyond money transfers, offering various financial services to underserved individuals. These include lending, investment, insurance, cryptocurrencies, and lifestyle services.

The vast fintech market in the Philippines holds immense potential. Fintech companies are actively seizing this opportunity, introducing innovative products across various sectors including payments, lending, and digital banking to meet the financial needs of diverse groups. Against the backdrop of sustained economic growth and accelerated digital transformation in the Philippines, the thriving fintech industry will drive financial inclusion, bringing new growth momentum and development opportunities to the Philippine economy.

Downland the report here.

#Philippine #Fintech #GCash #Digitaleconomy

.jpg)

.jpg)

(1).jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.png)

.png)

.png)

.png)

.webp)

图片2@2x.png)

All rights reserved.