April 5, 2025

Indonesia's telecommunications market has a rich history of evolution. As digital transformation accelerates, the country's telecom industry is experiencing rapid growth and significant changes. The market is projected to reach 244 trillion Indonesian Rupiah by 2024, with a steady CAGR of 6.1% from 2023 to 2027.

The Indonesian telecom market is dominated by three major operators, which account for over 90% of the industry's revenue. Fierce competition among these leaders has driven continuous reductions in mobile tariffs. To fuel growth, these operators are diversifying their portfolios, actively exploring areas such as IoT applications, AI integration, and cloud computing solutions.

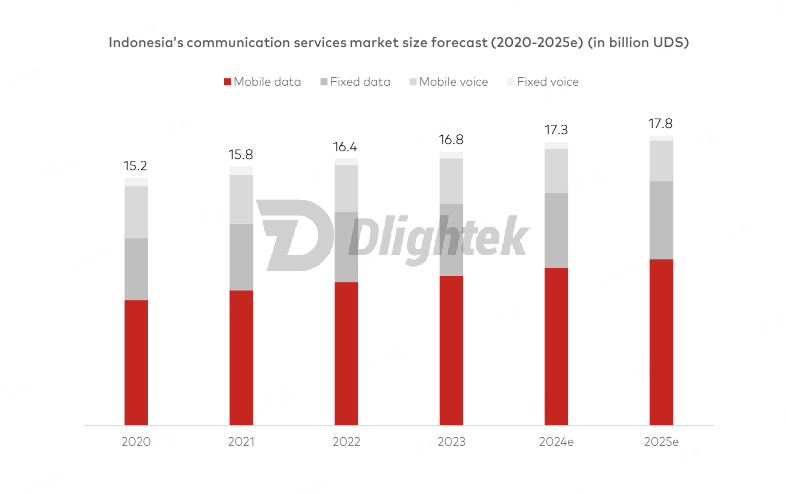

Telecom market expands consistently with mobile data becoming the primary revenue driver

According to Statista, with telecom operators broadening their business scale and scope, projections indicate an accelerated growth trajectory, with an expected CAGR of 6.1% for the period 2023-2027.

Indonesia’s communication services market size forecast (2020-2025e),

Source: 2024 Indonesia Telecommunications Industry Report, Dlightek

According to DataReportal, as of 2024, Indonesia has 185 million internet users, accounting for 66.5% of its total population. Mobile internet penetration is as high as 82.26%, with 4G connections making up 94% of the total. Indonesia is also actively introducing 5G technology, having launched its first commercial 5G service in 2021.

In terms of devices, mobile phones account for over 60% of internet traffic, becoming the primary gateway for internet access. twimbit data shows that as of 2024, mobile data services dominate Indonesia's communications service market revenue. This is followed by fixed data, mobile voice, and fixed voice services, in descending order of revenue contribution.

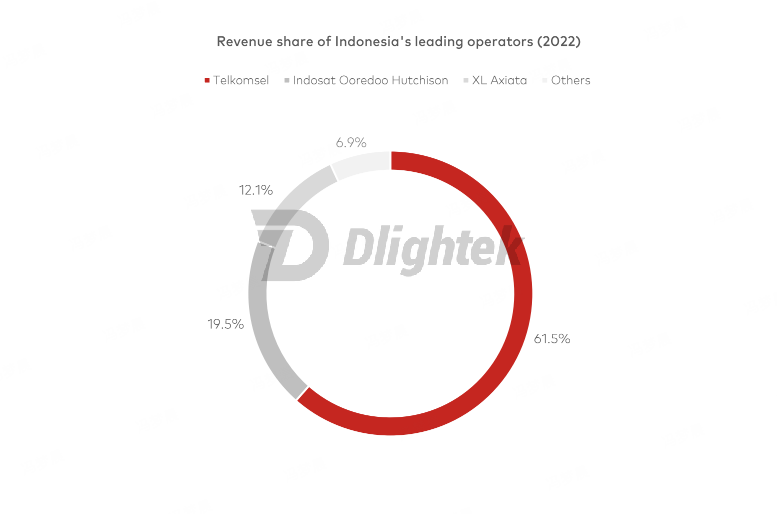

Three major mobile operators dominate the telecom market, offering diverse service

Indonesia's telecom market is dominated by three major operators: Telkomsel, Indosat Ooredoo Hutchison (IOH), and XL Axiata, collectively capturing over 90% of the country's operator revenue. These industry leaders have expanded their service portfolios through subsidiaries and sub-brands. For example, Telkomsel operates By.U, a Mobile Virtual Network Operator (MVNO), while XL Axiata acquired AXIS, formerly an independent MVNO.

The market ecosystem is further enriched by specialized service providers. Satellite communication companies like Pasifik Satelit Nusantara (PSN) play a vital role in connecting Indonesia's remote archipelagic regions. Additionally, Internet Service Providers (ISPs) such as FirstMedia, Biznet, MNC Play, and MyRepublic focus on delivering internet access services. As 5G technology rolls out and digital transformation accelerates, Indonesia‘s telecommunications landscape is poised for continued dynamic evolution.

Revenue share of Indonesia's leading operators (2022),

Source: 2024 Indonesia Telecommunications Industry Report, Dlightek

Telkomsel stands as Indonesia's largest telecom operator, boasting about 159 million subscribers and an annual revenue of 102.43 trillion Indonesian Rupiah, primarily driven by mobile data services. The company offers a comprehensive service portfolio catering to diverse market segments: For personal users, Telkomsel offers converged services such as Telkomsel One, prepaid services such as Telkomsel PraBayar, prepaid mobile data services Telkomsel Lite, and postpaid services Telkomsel Halo. For families, Telkomsel acquired IndiHome service in 2023, offering home phone, internet, and IPTV services. For enterprise users, Telkomsel provides network connectivity and security solutions, as well as business solutions such as membership management, financial management, and smart taxation.

Indosat Ooredoo Hutchison (IOH) stands as Indonesia's second-largest telecom operator, with its Q1 2024 financial report revealing a robust user base of 100.8 million. IOH, together with its subsidiaries and affiliates, offers a comprehensive suite of services including: Cellular services, ICT solutions, data centers, Fiber-to-the-Home (FTTH), e-payment services, financial services, and other digital services.

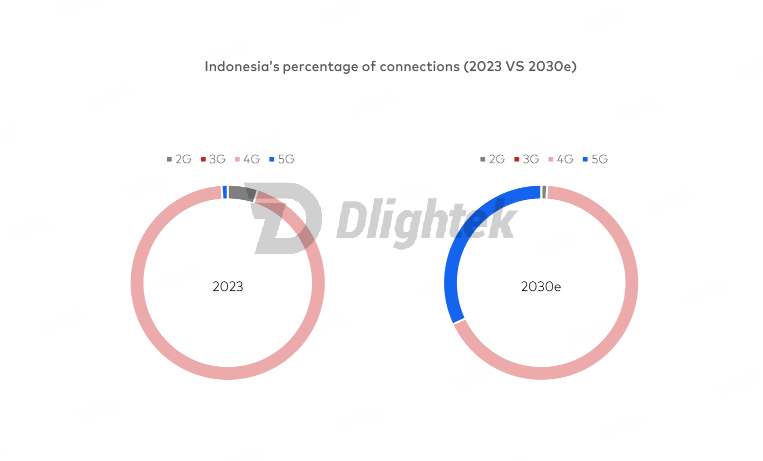

5G networks continue to expand, mobile data rates decrease yearly

Indonesia's 5G network development has been relatively modest compared to its Southeast Asian counterparts like Thailand and the Philippines. While Indonesia's 5G network quality improved by late 2023, its average download speeds still trailed behind Singapore, Malaysia, the Philippines, and Thailand. To boost network capacity, the Indonesian government launched the Palapa Ring project, establishing extensive network infrastructure across the archipelago through submarine and terrestrial fiber optic lines.

In recent years, major operators such as Telkomsel and Indosat Ooredoo Hutchison have made significant strides in 5G technology, steadily increasing the number of 5G base stations (BTS). GSMA forecasts that by 2030, Indonesia's 5G adoption rate will surpass 30%, potentially contributing over 41 billion USD to the GDP.

Indonesia’s percentage of connections (2023 VS 2030e),

Source: 2024 Indonesia Telecommunications Industry Report, Dlightek

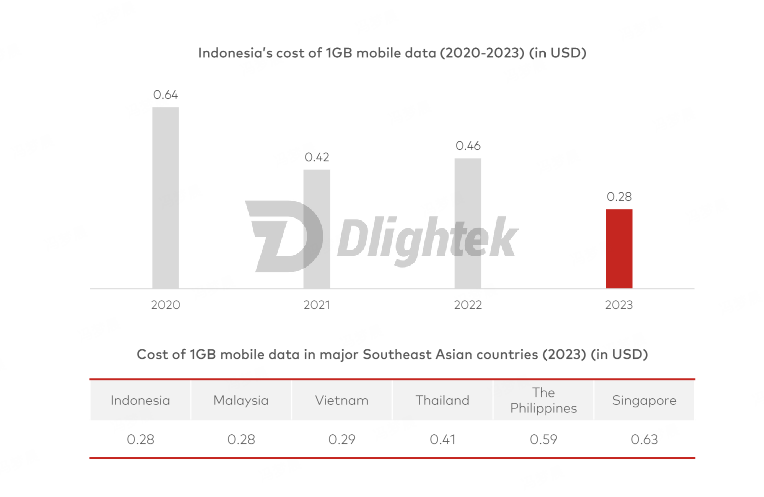

Mobile data rates in Indonesia have been decreasing year after year as mobile connectivity becomes more widespread. cable.co.uk data show that the price of 1GB of mobile data in Indonesia has fallen to $0.28 in 2023, one of the lowest among major Southeast Asian countries.

Indonesia’s cost of 1GB mobile data (2020-2023),

Source: 2024 Indonesia Telecommunications Industry Report, Dlightek

Additionally, data shows that prepaid users dominate the Indonesian mobile market, accounting for approximately 97% of total mobile users in 2022. Prepaid users have lower switching costs and tend to be less loyal. To reduce customer churn, major Indonesian operators frequently offer attractively priced data services to improve user retention.

Operators are diversifying revenue streams by expanding into cross-sector digital solutions

Indonesia's telecom industry is undergoing a major shift, transitioning from traditional connectivity services to a diversified revenue model.

In March 2022, Telkomsel launched INDICO, a subsidiary focused on vertical digital businesses including edtech, healthtech, and gaming. IOH partnered with Microsoft to offer cloud computing and IoT solutions for enterprise clients, broadening its service portfolio.XL Axiata has emphasized big data analytics, providing data-driven decision support services to government agencies and businesses. Meanwhile, Smartfren, another telcom operator, has actively promoted 5G technology applications through collaborations with Chinese tech firms, introducing innovative 5G solutions for industry and smart cities.

These diversification strategies not only expand the operators' revenue streams but also strengthen their competitive edge and resilience in the rapidly evolving digital economy.

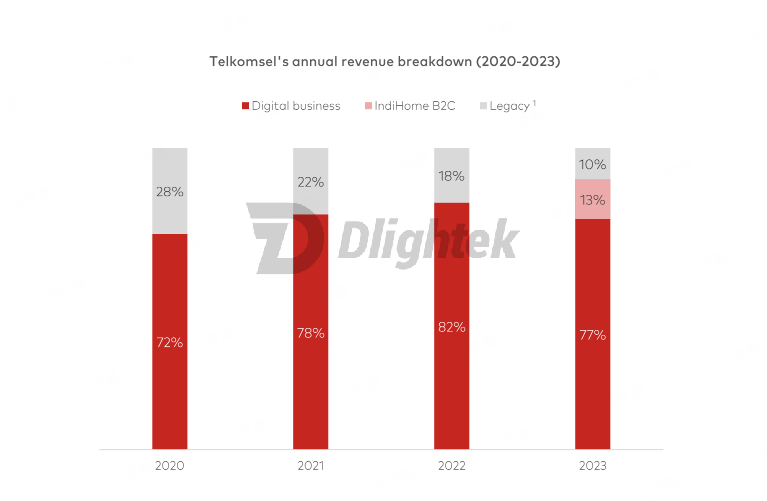

Telkomsel's annual revenue breakdown (2020-2023),

Source: 2024 Indonesia Telecommunications Industry Report, Dlightek

Indonesia aims to become a top-five global economy by 2045, in line with its Golden Indonesia 2045 vision. The government has prioritized ICT infrastructure development, as evidenced by the "2021-2024 Digital Indonesia Roadmap" and the "Masterplan for Acceleration and Expansion of Indonesia's Economic Development 2011-2025".

The Indonesian telecommunications industry is at a crucial stage of robust development. With the improvement of infrastructure, the promotion of 5G technology, the widespread adoption of smart devices, and the rapid growth of the digital economy, the industry is poised for significant opportunities. In the future, the Indonesian people will have the chance to enjoy more innovative services from the telecommunications industry. At the same time, industry competition will further intensify, potentially leading to more consolidation and strategic partnerships. Government policies will continue to play a key role in promoting digital infrastructure development and narrowing the digital divide. Overall, the Indonesian telecommunications industry is expected to become one of the important engines driving national economic growth and social development.

Downland the report here.

#Indonesia #Telecom #Telkomsel #Digitaleconomy

.jpg)

.jpg)

(1).jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.png)

.png)

.png)

.png)

.webp)

图片2@2x.png)

All rights reserved.