Home/ Latest trends

2025 India Telecommunications Industry Report: The world’s second-largest telecom market with over 800 million internet users

October 16, 2025

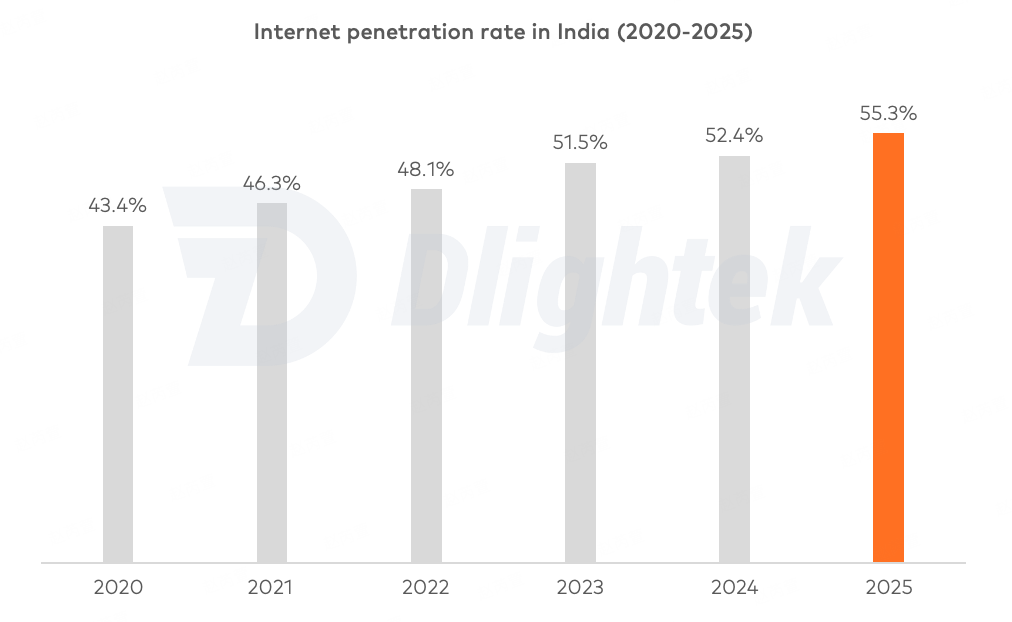

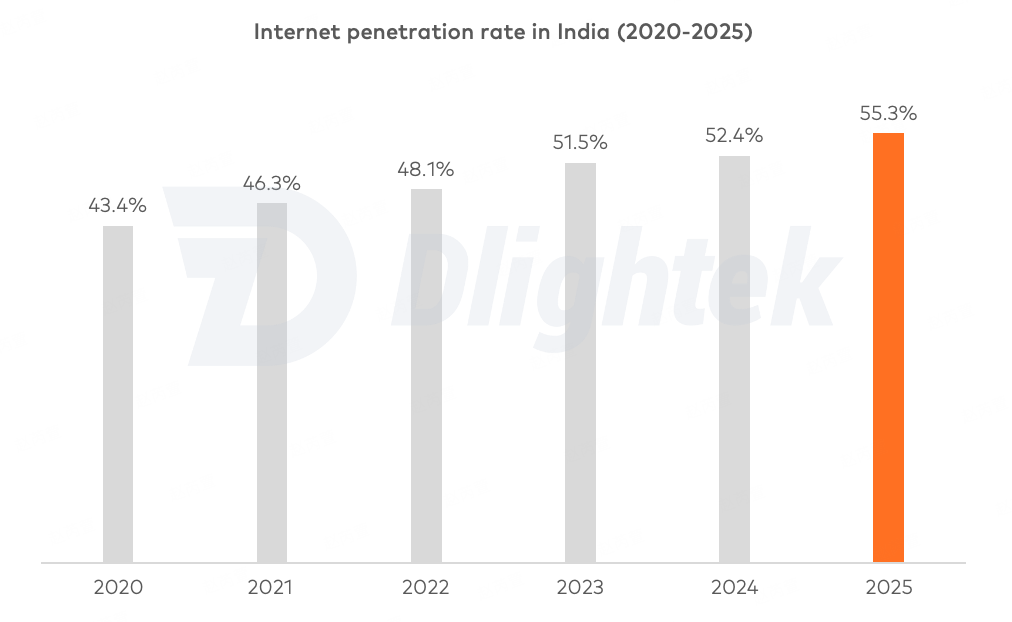

India, the world’s fifth-largest economy and most populous country, now has the second-largest telecommunications market globally. With around 806 million internet users and a 55.3% penetration rate, the “Digital India” initiative has upgraded network infrastructure, boosting median mobile speeds by 418% between 2024 and 2025. Mobile data remains highly affordable, at just 0.16 USD per GB.

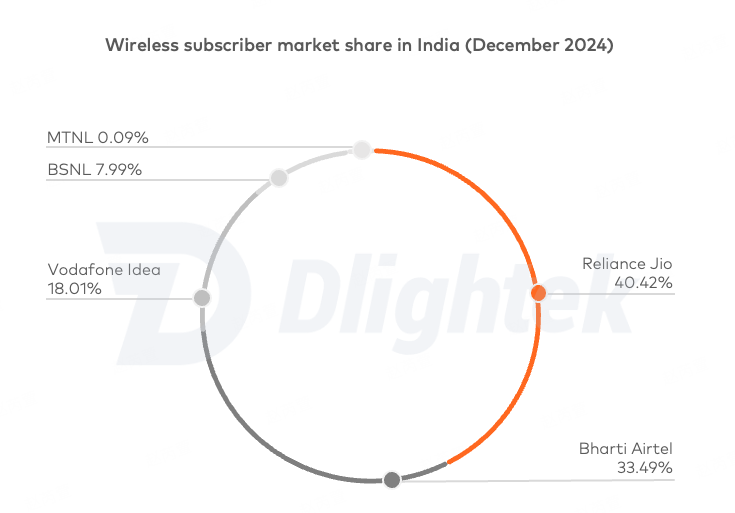

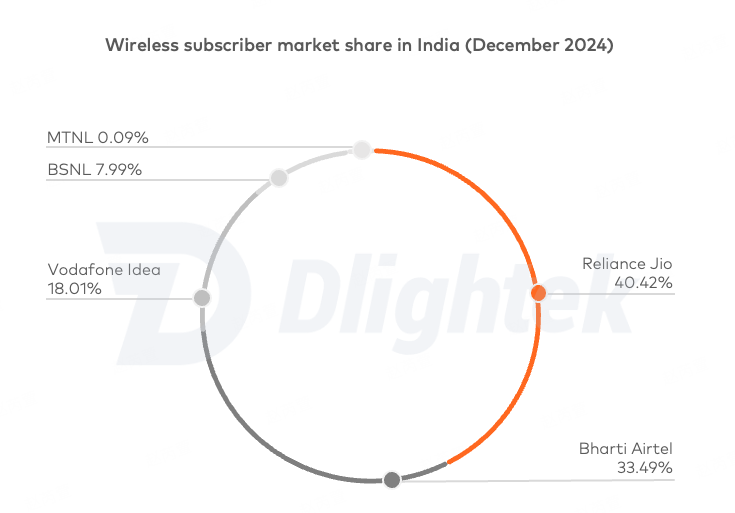

Reliance Jio and Bharti Airtel lead the market, followed by Vodafone Idea and the state-owned BSNL and MTNL. Supported by a large user base and favorable policies, India’s telecom industry is expected to grow from 53.18 billion USD in 2025 to 83.34 billion USD by 2030, at a CAGR of 9.4%, highlighting its strong growth potential.

Telecom outlook strong amid soaring data usage

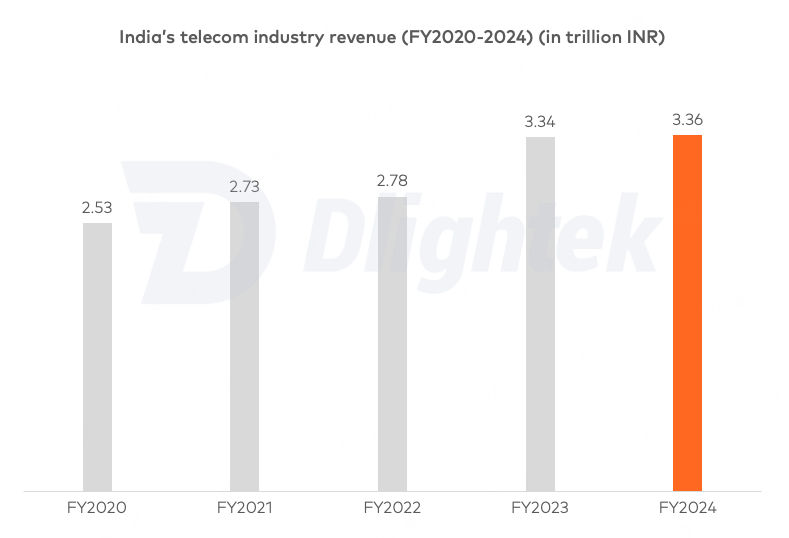

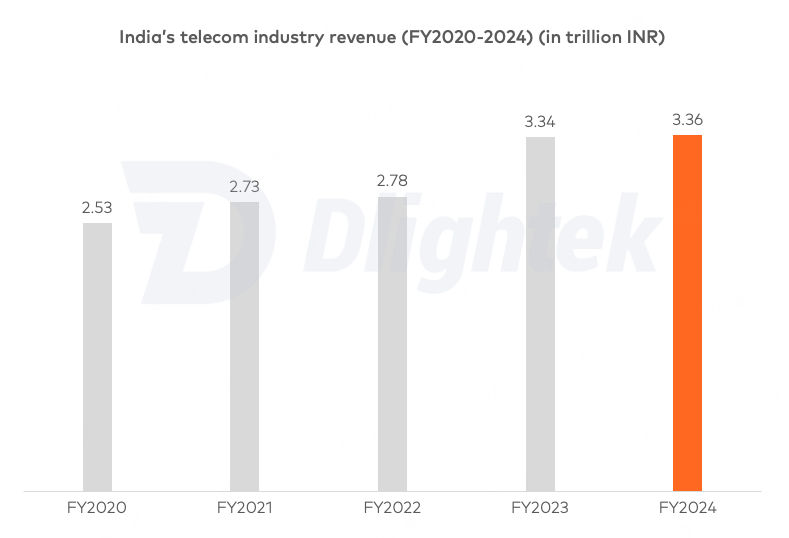

India has emerged as one of the fastest-growing major economies, with GDP projected to grow 6.2% in fiscal year 2025 and 6.3% in fiscal year 2026. Against this backdrop, the telecommunications sector has kept strong momentum, with total revenue steadily reaching 3.36 trillion rupees (about 40 billion USD) in fiscal year 2024.

India’s telecom industry revenue (FY2020-2024) (in trillion INR)

Source: 2025 India Telecommunications Industry Report, Dlightek.

As of January 2025, India’s internet user base reached 806 million, ranking second globally. The country also offers some of the cheapest mobile data in the world, with 1GB costing just $0.16, far below the global average of $2.59. These affordable rates, together with faster mobile speeds, have made it easier for people to go online, driving a surge in data usage. By June 2024, monthly use per wireless user averaged 21.30GB, up from just 61.66MB in March 2014.

Internet penetration rate in India (2020-2025)

Source: 2025 India Telecommunications Industry Report, Dlightek.

Two leading operators hold market share with ongoing price competition

India’s telecommunications market includes Reliance Jio, Bharti Airtel, Vodafone Idea, BSNL, and MTNL, with BSNL and MTNL being state-owned. The market is highly concentrated, with Jio and Airtel leading in both users and revenue, forming an almost duopoly and holding a clear dominant position.

Wireless subscriber market share in India (December 2024)

Source: 2025 India Telecommunications Industry Report, Dlightek.

India’s largest operator, Jio, transformed the market with its “low-price, high-quality” strategy, reshaping the competitive landscape. The company lowered data prices from 250 rupees per GB to just 10 rupees and introduced 4GB of free daily data, rapidly attracting a substantial user base. Jio’s entry prompted other operators to respond with intensified competition in both pricing and services.

Advancing 5G and satellite communications, expanding rural connectivity.

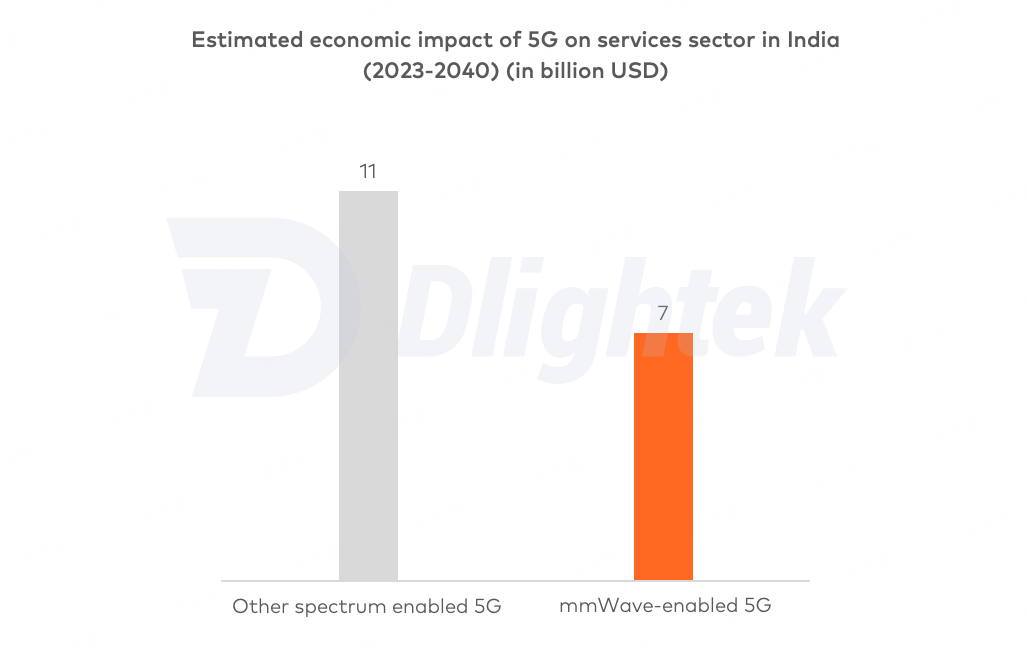

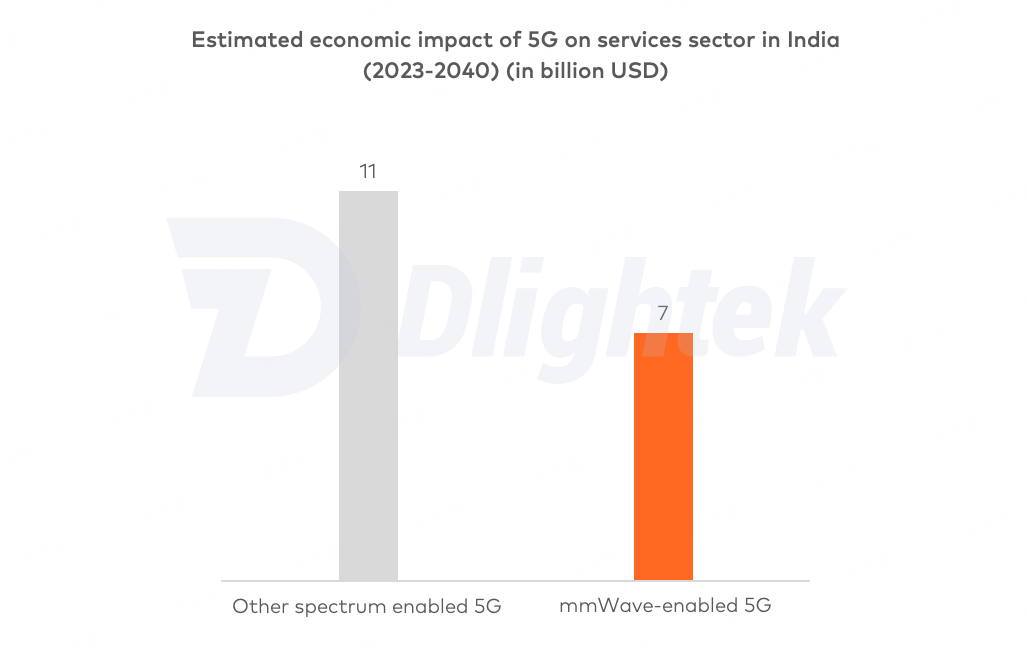

India is accelerating the rollout of 5G networks and satellite communication services. Between 2023 and 2040, 5G is expected to contribute 455 billion USD to the country’s economy. In 2024, the government resolved spectrum allocation issues for satellite communications and approved several service providers. India is set to launch satellite communication services in 2025, further strengthening its national digital infrastructure.

Estimated economic impact of 5G on services sector in India (2023-2040) (in billion USD)

Source: 2025 India Telecommunications Industry Report, Dlightek.

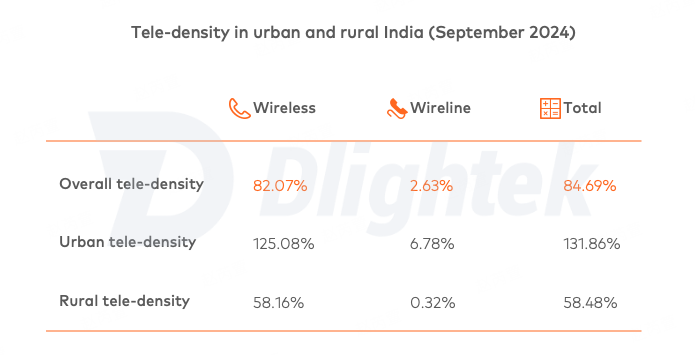

Although India has the second-largest number of internet users globally, its internet penetration rate remains below the global average, highlighting a persistent digital divide. To narrow this gap, the government plans to establish rural telephone facilities in more than 62,443 uncovered villages through subsidies from the Universal Service Obligation Fund, aiming to enhance network coverage and service quality in remote and rural areas.

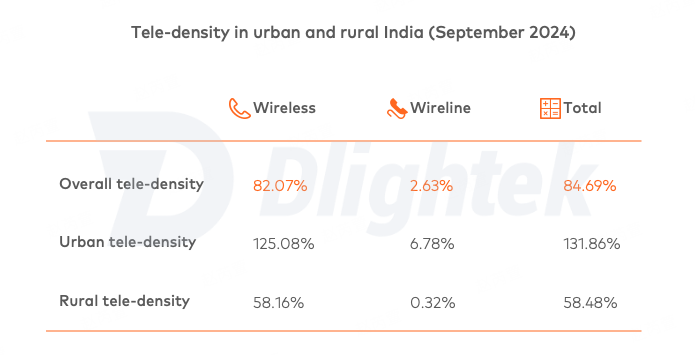

Tele-density in urban and rural India (September 2024)

Source: 2025 India Telecommunications Industry Report, Dlightek.

As a core sector serving more than 800 million internet users, India’s telecommunications industry is a key pillar of socio-economic development and a critical driver of data center expansion and digital service growth. Supported by technological progress, market competition, and government initiatives, the sector continues to advance along a strong growth trajectory. Looking ahead, telecommunications is set to play a pivotal role in India’s pursuit of a trillion-dollar digital economy, with significant growth potential ahead.

Download the report here.

MORE NEWSMore News

2025 India Telecommunications Industry Report: The world’s second-largest telecom market with over 800 million internet users

2025 Vietnam Telecommunications Industry Report: 5G coverage projected to reach 99% by 2030

DataSparkle newly release the report of The Changing Landscape pf Africa’s Mobile App Market 2025

Game On, Grow Together: The 2025 Dlightek Game Developers Private Conference Successfully Concluded

2024 Indonesia Telecommunications Industry Report: 66.5% population is online

Philippines Fintech Industry Report 2024: The Secrets Behind the Growth of Southeast Asia's Fintech Upstarts

2024 Philippines Telecommunications Industry Report:Opportunity for 122 Million Mobile Subscribers

2024 Pakistan E-commerce Industry Report:New Opportunities in the US $6.7 Billion Market

Telecommunications Industry in Pakistan 2024: Mobile Subscribers Exceeded 192 Million, Revenue Exceeded 850 Billion PKR

Fintech Industry in Pakistan 2024: Fintech Leads Economic Take-off for 240 Million Population

2024 Kenya Fintech Industry Report:Uncovering the Rise of Fintech in Kenya

Dlightek Business Summit 2024 in Nigeria: Illuminating the Path to Global Digital Advertising

Fintech Industry in Nigeria 2024: Bridge finance and future

Dlightek Game Developer Summit in Pakistan: Crafting a New Blueprint for Gaming

Telecommunications Industry in Nigeria 2024

Eagllwin Marketing Platform: The Snowball Attribution Detection Tool heralds a new era of efficient advertising deployment

Africa, South Asia and Southeast Asia's Mobile Game Market Insights in October 2024

PalmStore and AHA Games: leading the way in distributing games in emerging markets

Palm Store is renewed and upgraded, aiming to provide a better user experience...

New upgraded!AHA Games creates the ultimate gaming experience...

Eagllwin, a one-stop overseas marketing platform, helps the leading ride-hailing application in Kenya expand the market and achieve another great success

Afreximbank – Country Brief on Nigeria 2024

Telecommunications Industry in Kenya 2024

Strong momentum in African smartphone transition, expected to continue growth and surpass feature phones

Tools App: Auto clicker sees a 3,000% increase in active users in the African market

Global tech giants in Africa's AI gold rush

Report on Africa's digital economy, China-Africa cooperation released in Kenya

DataSparkle releases "2024 The Changing Landscape of Africa's Mobile App Market" report, deciphering the immense growth potential of the app sector...

The potential of Kenya's SMS service market is enormous, with a message volume of 52.4 billion in 2023

Africa's emotional AI hits a new wave as AI companion market value soars

The big reveal of African AI App:AI is leading the way in gaming, in which African country is it most popular?

The big reveal of African AI App in 2023: Monthly active users surpass ten million, usage duration surges!

Dlihgt Cloud SMS (Short Message Service) covers over 200 countries/regions worldwide, helping enterprises to explore global markets

Pinduoduo's Temu launched its e-commerce site in South Africa on January 16, South Africa e-commerce market 2024 is about to face exciting changes

Africa's food delivery market: two giants quit one after another, active users of food and drink apps down 15%

Short-form streaming platform ReelShort's active user base soars 9,100 % in emerging markets as "handsome high-powered boss" kills worldwide

ECA and Transsion Sign Agreement to Foster and Accelerate Digital Transformation in Africa

How will TikTok Shop evolve in the Indonesian market after the ban?

From Europe to Africa, exploring the appeal of the Premier League to Africa

A week of record uninstalls and a name change to "X." How's Twitter?

Twitter’s status remains unshakable as Threads' user engagement drops and daily activity plummets 50% in a week?

Africa's FinTech investment is booming, who will be the next unicorn?

MeetYou has entered the top 10 ranking, and the layout of the African health industry is emerging.

Nigeria's FinTech revenue increases to $540 million by 2022, or will it continue value growth?

TikTok and Kwai have entered the African market, what is the charm of African short video industry?

.jpg)

.jpg)

(1).jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.png)

.png)

.png)

.png)

.webp)

图片2@2x.png)